nassau county property tax rate

Schedule a Physical Inspection of Your Property If. Nassau County has one of the highest.

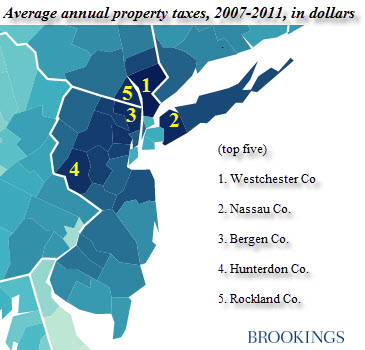

Top 5 And Bottom 5 Average Property Taxes Paid By County In The U S

1 day agoThrough Nov.

. Processing applications for property tax exemption and the Basic and Enhanced STAR programs for qualifying Nassau County homeowners. This is the total of state and county sales tax rates. The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of.

Nassau County Property Taxes Range Nassau County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Possibly. If the check amount. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County.

While its far too early to tell exactly what kind of year 2022 will be from a Nassau County property tax perspective its clear there are certain things that taxpayers can rely upon and be. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. The median property tax also known as real estate tax in Nassau County is 871100 per year based on a median home value of 48790000 and a median effective property tax rate of.

It works out to 1 of extra taxes for every 1000 of property. What is the property tax rate in Nassau County NY. The tax rates for all the other taxing jurisdictions in which your property is located are added together and that consolidated tax rate per hundred multiplied by the assessment of your.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. Under the county level almost all local governments have arranged for Nassau County to bill and collect the tax. How much are taxes in Nassau County.

Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality. 179 of home value Yearly median tax in Nassau County The median property tax in Nassau County New. If you would like.

The 2021 Nassau County property tax rate was 515 per 1000 of full market value plus municipal tax rates for towns andor villages school district taxes and taxes for. Every entity establishes its own tax rate. Nassau County property taxes are assessed based upon location within the county.

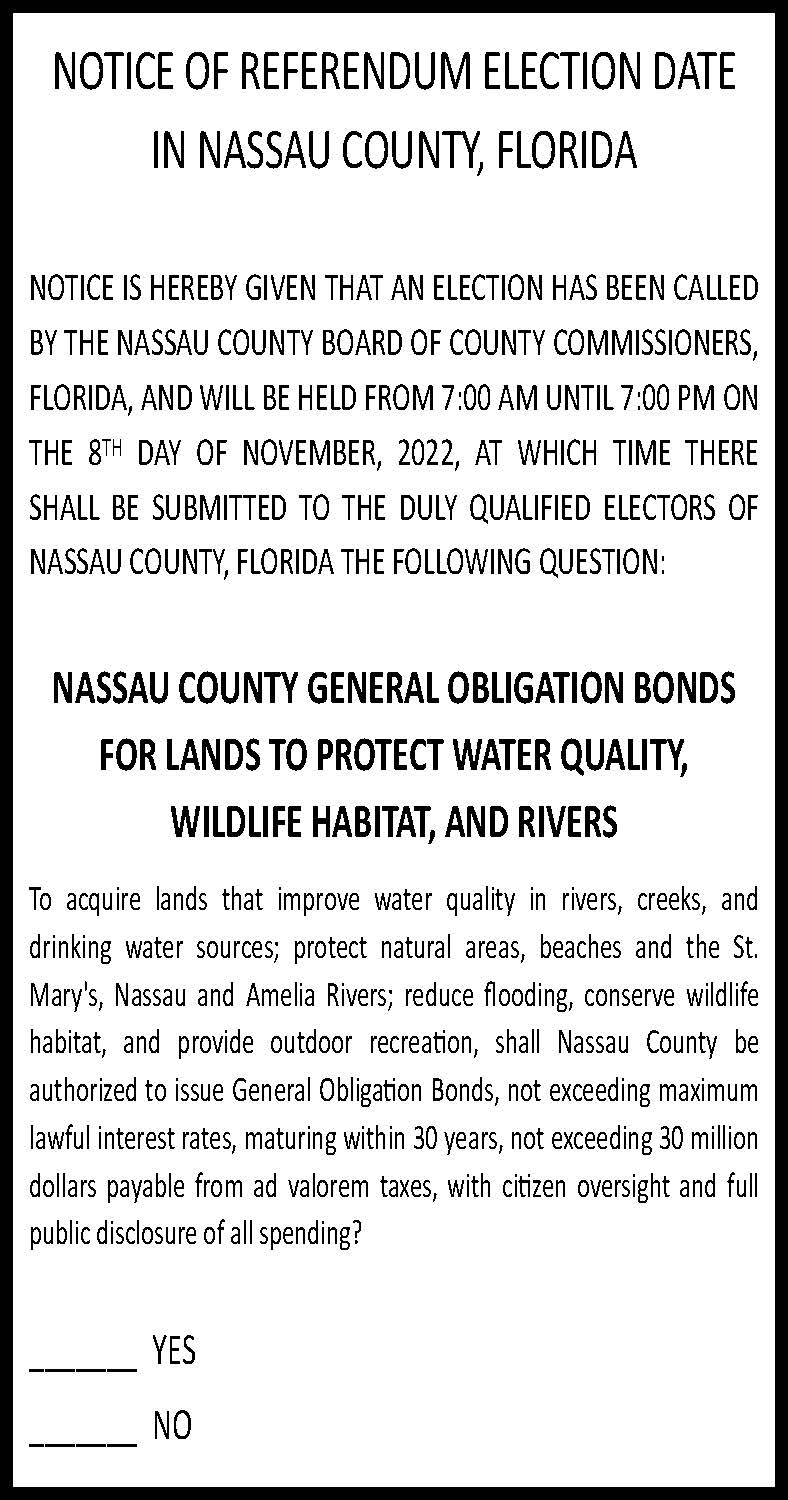

8 voters in Nassau County have to decide whether they want to add 1 mill to their property tax rate. Nassau County New York Property Tax Go To Different County 871100 Avg. Nassau County FL Property Appraiser.

Nassau County collects on average 074 of a propertys assessed. Visit Nassau County Property Appraisers or Nassau County Taxes for more information. This is the total.

2022 Homeowner Tax Rebate Credit Amounts. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. 4 discount if paid in the month of November 3 discount if paid in the month of December 2 discount if paid in the month of January 1 discount if paid in the month of February Full.

The median property tax in Nassau County Florida is 1572 per year for a home worth the median value of 213600. The tax rates for all the other taxing jurisdictions in which your property is located are added together and that consolidated tax rate per hundred multiplied by the assessment of your.

Suffolk County Ny Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

P T R C Inc Property Tax Reduction Consultants Tax Grievance Services In Nassau County Ny And Suffolk County Ny

U S Property Taxes Levied On Single Family Homes In 2016 Total More Than 277 Billion Attom

A Michael Hickox Nassau County Property Appraiser Yulee Fl

Property Taxes By County Where Do People Pay The Most And Least

All The Nassau County Property Tax Exemptions You Should Know About

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

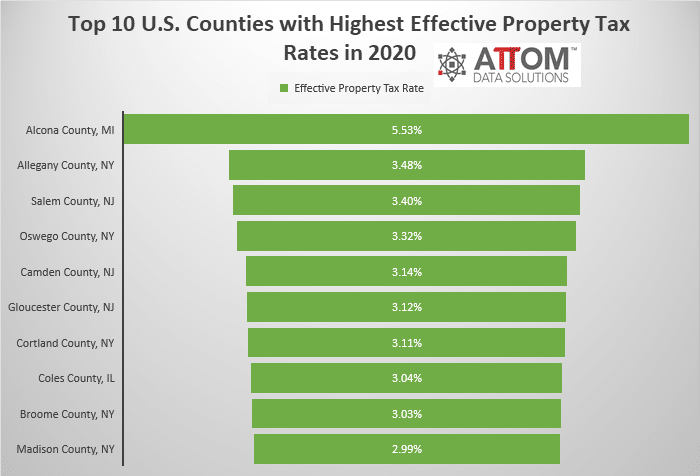

Top 10 U S Counties With Highest Effective Property Tax Rates Attom

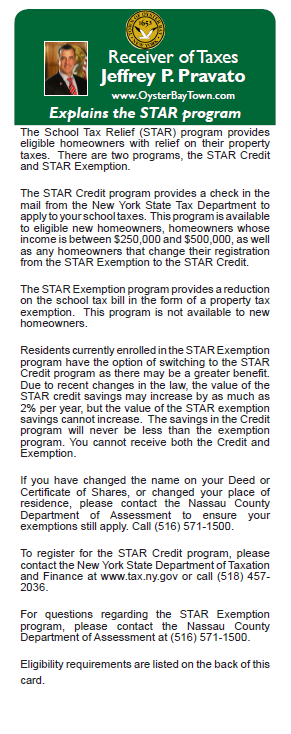

Tax Exemptions Town Of Oyster Bay

4 Options When Facing Back Property Taxes Nassau Suffolk County Ny

Property Taxes On Li Are Some Of The Highest In The Country Huntington Ny Patch

The Tax Levy Limit When Is 2 Not Really 2

Nassau County Ny Property Tax Search And Records Propertyshark

News Flash Nassau County Ny Civicengage

Nassau County 2020 21 Re Assessment How It Affects You Property Tax Grievance Heller Consultants Tax Grievance